SMB Loan Origination Software

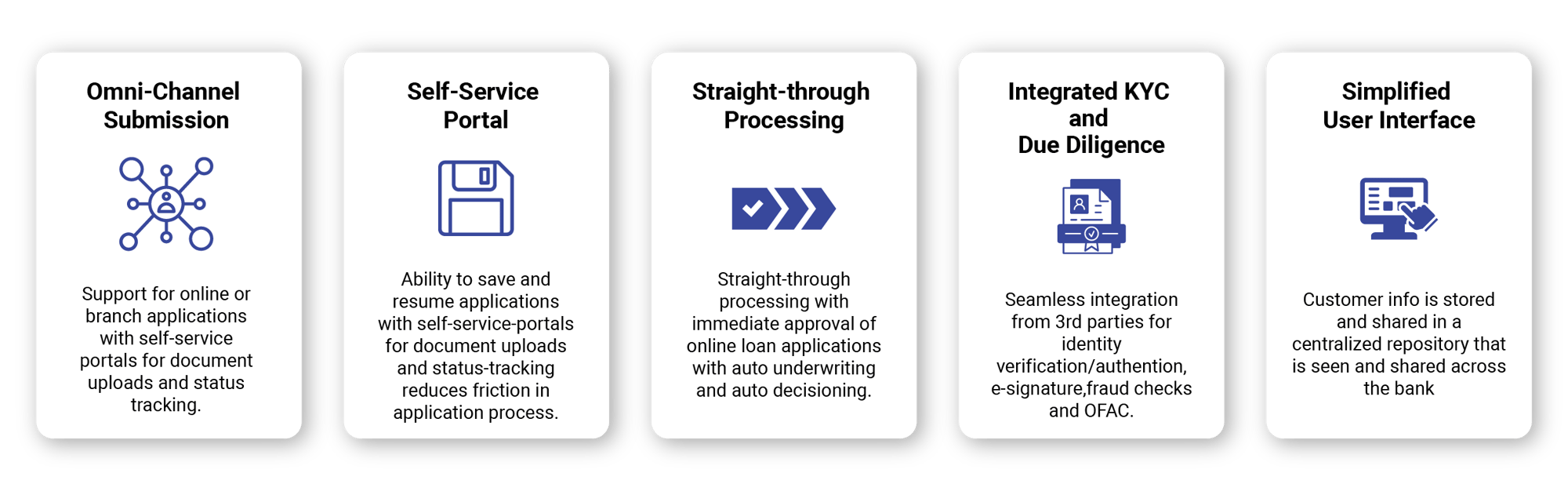

Vikar's SMB loan origination software stands out as a true differentiator in the market. We’re proud to be the only solutions provider offering true omni-channel submission, enabling SMB borrowers to apply in-branch, online, or effortlessly transition between both. Our seamless integration ensures a smooth and flexible experience every step of the way.

Our software provides banks an end-to-end loan origination transformation that eliminates manual dropouts and enables cross selling opportunities to grow new accounts and deposits with local community business owners.

Designed for Efficiency and Growth

Vikar's SMB Software tackles the outdated manual processes that plague traditional loan origination for small businesses. These processes are slow, inefficient, and require multiple interactions, hindering scalability and frustrating customers who demand fast, convenient digital services. Vikar's solution empowers banks to digitally transform the entire loan origination process for SMBs. Here's how:

ACCOUNT OPENING:

Open accounts anytime in the loan process (within 3 minutes) either online or at the branch

The SMB Market Opportunity

There are over 33 million small businesses in the US employing 35% of the private-sector workforce.

A 2024 Goldman Sachs survey found that 77% of small businesses were concerned about their ability to access capital.

An OnDeck survey reported that 70% of small businesses had less than four months of operating cash on hand.

Large corporations have access to public markets but small businesses have fewer financing options available and consequently debt financing through loans emerges as their optimal choice for obtaining needed capital.

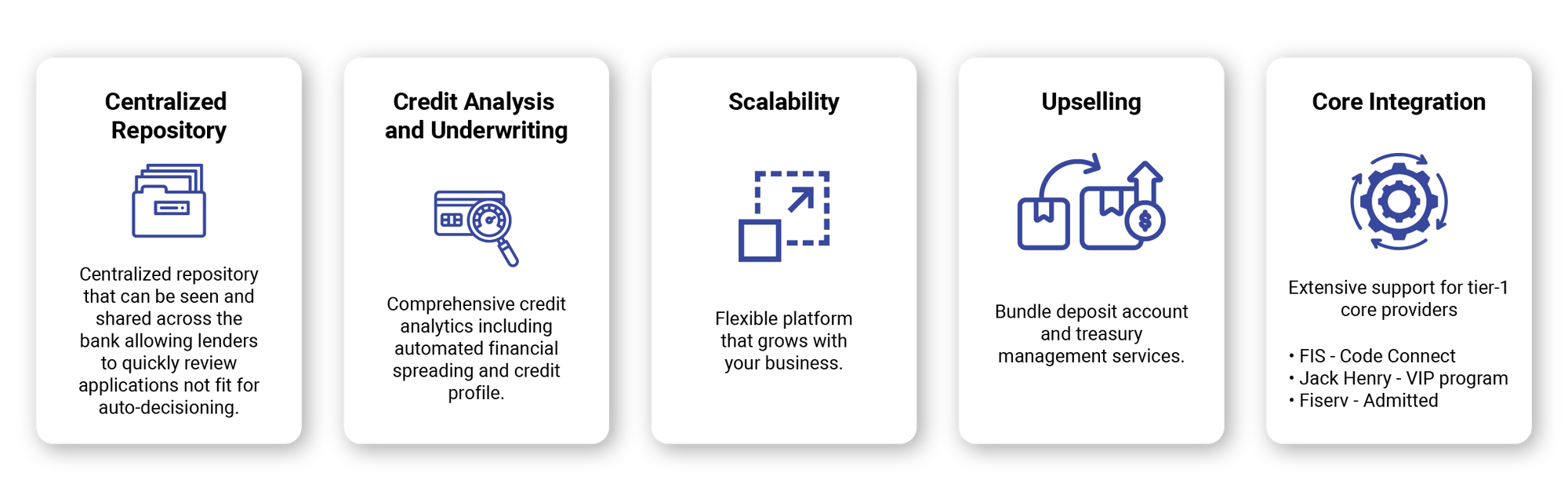

Core Support, Rules & AI

Core Integration. Extensive support for tier-1 core providers

- FIS - Code Connect

- Jack Henry - VIP program

- Fiserv - Admitted

Rules. The vendor should include support SBA Lending Rules.

Prepares you for AI. AI and machine learning present a growth opportunity for lenders. Digitization of your infrastructures enables AI that can help make lending decisions faster and more efficient by improving the lender’s ability to quickly analyze data to create risk profiles and identify patterns.

Support Direct Integration for Account Opening - open accounts anytime in the loan process within (3) minutes either online or at the branch

Automated decisioning - instantly approve loans based on your own model, reducing human intervention while improving the speed and quality of credit decisions.

Interested in learning more about Vikar's SMB Loan Origination?

Let us assess the suitability of our SMB Loan Origination solution for your financial institution.